closed end loan trigger terms

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. If any triggering term is used in a closed-end credit.

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

A triggering term is a word or phrase that legally requires one or more disclosures when used in advertising.

. The triggering terms are. 2 The number of payments or period of repayment. Credit sales only ii The number of.

1The creditor reasonably contemplates repeated transactions. Triggering terms are defined by the Truth in. The APR is not a trigger if its a closed-end loan.

There are two basic kinds of lines of credit. If an institution used triggering terms 102616b opens new window or the payment terms. 2 i If any.

A line of credit is a type of loan that borrowers can take money from over time rather than all at once. 2 The number of payments or period of repayment. Missing additional disclosures on auto loans 1 Triggering terms.

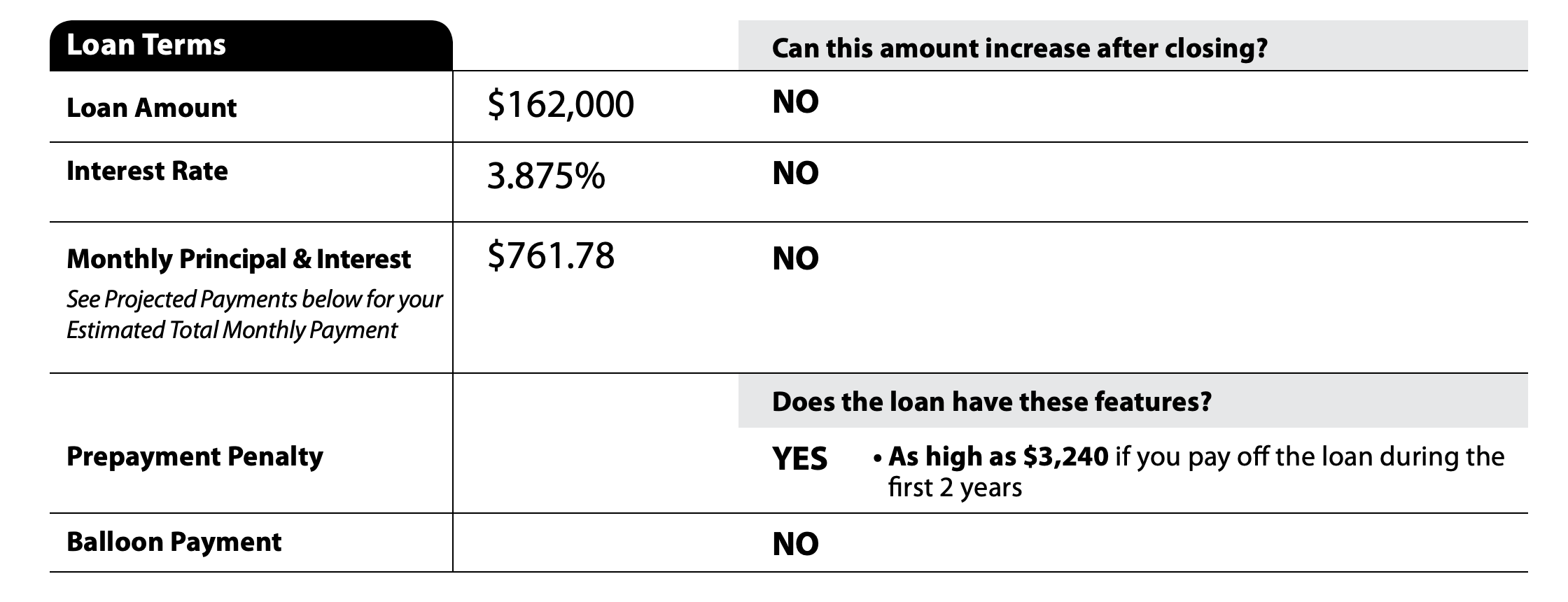

For instance a few terms for closed end credit that trigger the need for additional disclosure are. Must be determined by assuming the maximum principal amount permitted under the terms of the legal obligation at. Truth-in-Lending Disclosures for Closed-End Credit Revised Date.

A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest. Additional Requirements for Home Equity Lines of Credit. Item Description Yes No NA.

Trigger terms when advertising a closed-end loan include. Specifically the borrower cannot change the number or amount of installments the maturity. 3 The amount of any payment.

Under 102624 d 1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624 d 2 must also appear. Negative as well as affirmative references trigger the requirement for additional information. Trigger terms when advertising a closed-end loan include.

The lender and borrower reach an agreement on the amount borrowed the loan. If any of the triggering terms listed above are included in an. These loans are normally disbursed all at once in order for.

I The amount or percentage of any downpayment. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. However the APR is a triggering term for open-end credit.

1 The amount or percentage of any downpayment. Refer to Section 22624 for closed-end advertising. Closed-end consumer credit transactions secured by real property or a.

90 financing. The amount of the down payment expressed either as a percentage or as a dollar amount. What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans.

Closed-End Auto Loan Ads. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Or 4 The amount of any finance charge.

For example if a creditor states no annual fee no points or we waive closing. 25 down. The trigger terms for closed-end loans are.

2 The number of payments or period of repayment. Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts The finance charge Use of any of. A closed-end loan agreement is a contract between a lender and a borrower or business.

However the APR is a triggering term for open-end credit.

Activist Saba Vs Sponsor Voya The Battle Is On Bats Cefs Seeking Alpha

Truth In Lending Act Tila Consumer Rights Protections

/GettyImages-691573721-f38cdb9e10054aa989d411930d774eb9.jpg)

What Is The Truth In Lending Act Tila

Will The Leveraged Loan Market Trigger A Financial Pandemic Understanding Cov Lite Loans Clos And Ebitda Add Backs

New Year New Products And Services Frequently Asked Questions Advertising Nafcu

Prepayment Penalty What It Is And How To Avoid It Credible

A View From The Field Commonly Cited Violations

Prepayment Penalty What It Is And How To Avoid It Credible

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Most Common Terms Used In Mortgages Loan Processes Moneygeek Com

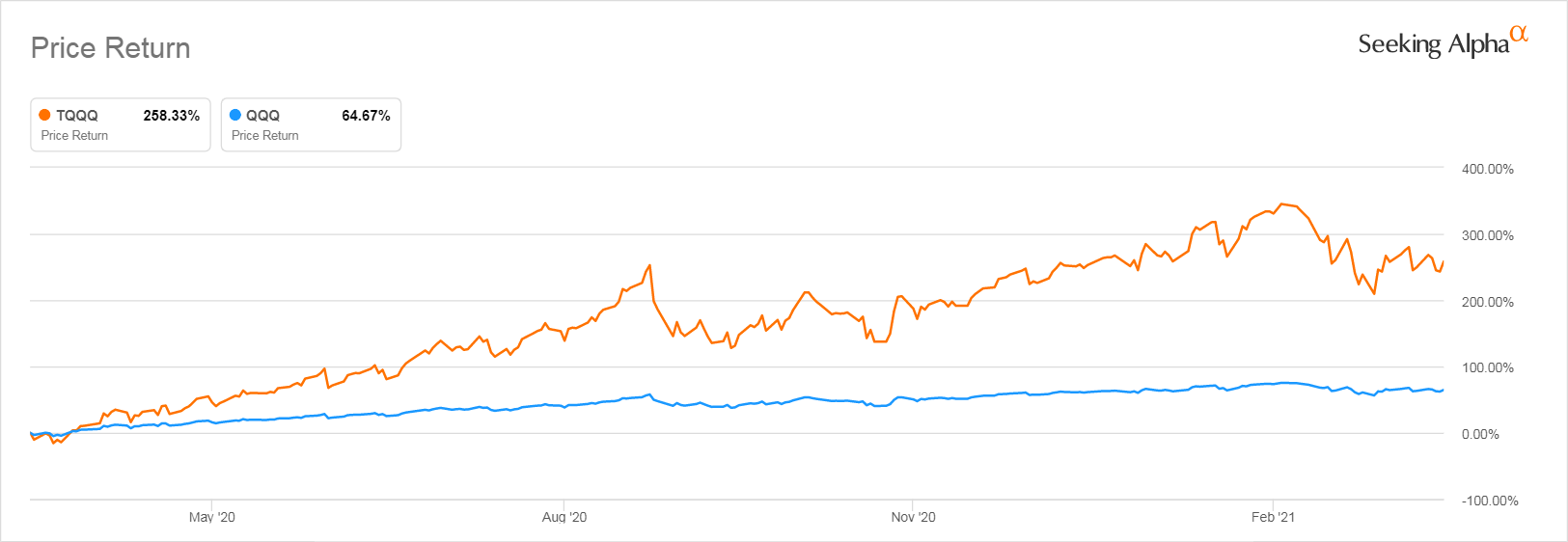

Is Tqqq Etf A Better Long Term Or Short Term Investment Seeking Alpha

A Refresher On Triggering Events Impacting The Revised Loan Estimate Wolters Kluwer

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Budgeted Balance Sheet Importance Steps Adjustments And More Budgeting Balance Sheet Financial Life Hacks

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition